MONETARY AGGREGATES AND BANK MONEY

Monetary Aggregates

When we speak about money, we usually refer

to the coins and notes in legal circulation. There are, however,

other modes that have more or less similar characteristics: value,

liquidity, mode of payment, etc.

When the Central bank tries to control the level

of liquidity (quantity of money) in the system, it analyses different

monetary aggregates according to the included concepts.

The most used aggregates, classified with more

or less aptitude are:

Cash in the public's hands (M0):

Currency (coins and notes) in legal circulation.

M1: currency in circulation

+ checkable deposits. M1 represents the assets that strictly

conform to the definition of money.

M2: M1 + saving deposits

in credit branches.

M3: M2 + large time

deposits and other money-market funds.

Liquid shares in the public's

hands (ALP): M3 + other components.

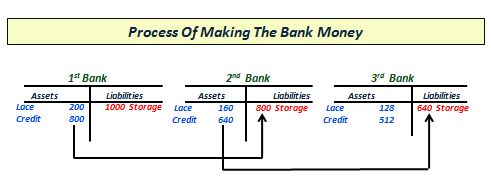

Bank Money

The financial entities (banks, savings banks,

etc) receive deposits from their clients into their acounts (which

is called bank money). This branches use these deposits to grant

credit.

For example: if a bank receives a

10.000 euros deposit from a client, part of this money will

be left in the bank to cover withdrawals (let's suppose that

this quantity is 1.000 euros). The rest of the money will go

towards credits (9.000 euros).

Part of the income of these credits returns

to the financial entities in the form of new bank deposits.

For example: a company that receives

a credit of 9.000 euros uses the money to buy a piece of machinery.

The seller receives the money from the sale and deposits the

money into his current account.

The bank that works with this seller

receives a new deposit of 9.000 euros and as we have already

seen in the previous example, they will leave a part of this

money in the bank (for example, 800 euros) and they will use

the rest (8,200 euros) to give out new credits.

We see that an initial deposit of 10.000 euros

has started a mechanism that means that the total sum of deposits

equals 19.000 euros (the inital 10.000 and the 9.000 which we

have just seen). And the process continues.

In short, banks multiply the value of their

deposits (they create bank money).

The commercial bank

transforms the deposits into a much larger quantity of bank money.

How much bank money

can be created?

To answer this question, we will start by defining

the concept of "mandatory bank reserve".

When financial organisatons receive

a deposit, they have to ensure a certain percentage of the amount

is accessible for withdrawls. This percentage is the "mandatory

bank reserve".

The Central Bank determines this

percentage, that is to say, they determine the amount the banks

have to have available in liquid form from the public's deposits

so that people do not have a problem when they want to withdraw

money.

The total amount of bank money generated by

the banks is determined by the "bank money multiplicator".

Bank money multiplicator

= 1 / Mandatory bank reserve

Let's continue with the example:

Let's suppose that in the case that

we have been analysing, the mandatory bank reserve is 10%. Therefore,

the bank money multiplicator will be:

Bank

money multiplicator = 1 / 0,10 = 10

Therefore, the banks will be able

to generate 10 times more bank money compared to the deposits

that they receive: if the initial deposit is 10.000 euros, the

bank money that they can generate is 100.000 euros.

This will be the maximum potential

sum of bank money that can be generated, what this does not

mean is that the bank will employ the whole amount available

in the credit concession, the credits may not return as deposits

in banks, etc.